Write us!

[email protected]

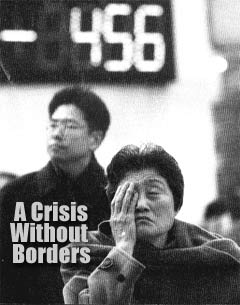

Is Global Economic Collapse Inevitable?

By NAT WEINSTEIN

Ever since the information-technology bubble burst last March, a day rarely passes without an ominous headline in the mass media concerning the economic downturn. But so long as it had appeared that only the so-called “new economy” was sliding steadily downward, the economic experts could reasonably have hoped that the overall economy could reestablish its equilibrium. However, concerns that something more serious was afoot began to spread at the beginning of this year when the so-called “brick and mortar” sector of the economy, encompassing the country’s basic industrial infrastructure, also began showing steadily increasing signs of distress.

Throughout February, government and industry reports of declining factory orders and almost daily announcements of layoffs in basic industry appeared alongside disappointing end of the year sales reports, reduced estimates of future profits and reports of a serious decline in consumer confidence.

Meanwhile, the stock market, which is not, as many believe, noted for signalling economic events to come, but rather reflects the effects of events past, has been gyrating madly with sharp rises and falls in stock prices since March 2000—with the trend generally downward. Even so, this is not to say that what happens on Wall Street doesn’t affect the economy as a whole. To be sure, it works both ways, yesterday’s effect becoming today’s cause. Consequently stock market volatility is impacting on the fundamental economic forces deeply at work within the economic infrastructure of capitalism.

The Feb. 25 New York Times took note of the extremely tenuous balance between contradictory economic forces in an article headlined, “It’s Up, It’s Down: Playing Games With the Economy.” The reporter, Richard W. Stevenson, began his piece by noting that Alan Greenspan had undergone a “role reversal.” From being “the last line of defense against irrational exuberance,” Stevenson ironically observed, “now the Federal Reserve chairman has been reassuring Congress that the economy should pull quickly out of its downturn and resume its upward trajectory.”

The Times reporter sums up the confusion among economic experts who have been disputing whether the current slowdown is merely a short, sharp period of readjustment or whether it is the first step in a long, painful collapse of a bubble economy.

“On that score,” Stevenson wrote, “Mr. Greenspan is the head cheerleader for the more optimistic school. From his perspective, the United States is enduring a serious but transitory ‘inventory adjustment’ to a more sedate pace of growth and a less frothy stock market.”

Sounds like good news? But, perhaps not. The reporter clarifies the meaning of Greenspan’s deliberately ambiguous reference to an “inventory adjustment” by defining it as “when car dealers have too many SUVs on the lot or the plastics factory decides to hold off on its plans to double capacity.” Thus, while his comment has a decidedly optimistic spin, it still is typical Greenspanian oracular double-speak designed to soften the impact of economic bad news—in this case, the worst news of all—evidence of a classic crisis of overproduction.

The pessimists, however, were not taken in. They argued, rather, that the decisive trend is toward declining profits and cutbacks in investment—another symptom of what capitalists prefer to call “overcapacity”—not “overproduction,” which has a Marxist ring. But the most astute of bourgeois economists are hinting, as we shall see, that this may very well turn out to be the very beginning of a massive crisis of overproduction on the order of the one that began in 1929.

The meaning of the debate

The Op-Ed section of the March 11 New York Times, for instance, printed two typical contributions to the debate. The first, by one of its regular economic columnists, Paul Krugman, and the second by John Kenneth Galbraith, the more academic of the two bourgeois economists (Krugman reflecting the opinion of the optimists, and Galbraith that of the pessimists).

Krugman’s point of departure is focused on Japan’s ever-deepening crisis and what he calls, the “startling declaration” by Japan’s finance minister, Kiichi Miyazawa, that his government’s finances were close to a “catastrophic situation.” Krugman acknowledged that what Miyazawa said was true—that “Japan was caught in a fiscal and economic trap”—but he dissented from Miyazawa’s extremely pessimistic declaration, saying that there are “still policy options that might allow the country to escape from that trap.” Krugman’s suggested “option” was that Japan adopt a policy of “aggressive monetary expansion.” And he further faults the Bank of Japan for devoting “considerable effort to devising creative reasons why it shouldn’t.”

Krugman’s argument is that as bad as Japan’s plight might be and risky as any solution might be, it’s better to take a chance rather than do nothing and let the economy slide further down the slippery slope to disaster.

But Japan has indeed been taking exactly such risks for the past decade by printing a huge mass of new currency to finance a lavish public works program designed to jump-start Japan’s stagnating economy by building roads and bridges—whether needed or not—for most of the past decade.

Krugman, furthermore, unjustly criticizes Miyazawa for having just recently raised interest rates from zero to .15 percent (that’s fifteen hundredths of one percent!). But the Japanese finance minister’s microscopic increase in interest rates was imposed with the vain hope that it would attract purchases of government bonds to finance many years of huge budget deficits, which have resulted in a public debt that is at least 1.4 times the size of the country’s gross domestic product.

Krugman also seems to have overlooked the remarks by Miyazawa that prefaced his reference to “catastrophic” finances. He had first explained that it comes after years of spending on public works projects that have left the government’s coffers “near a state of collapse.”

So much for Krugman’s sage advice. But he didn’t stop there. He went on to criticize pessimists in the United States, as well, for succumbing to what he calls the “hangover theory,” which he ridicules as the “view that a recession is inevitable, even desirable, after a period of economic excess.”

But what could be more “normal” than for a recession—not to mention a depression—to be the logical result of what all the experts agree has been history’s longest economic boom that turns out to have been a gigantic bubble that was doomed to burst?

Galbraith disagrees

John Kenneth Galbraith, whose credentials as a sober bourgeois academic economist are highly respected, however, is not so cavalier as to rebuke the Japanese for failing, after trying for ten desperate years, to come up with a solution to their economic crisis. Galbraith’s approach to the troubled global economy, moreover, gets closer to the real dilemma facing world capitalism—although he focuses on the United States and what he considers to be a mistaken economic policy being imposed by the Bush administration. But, as we shall see, Galbraith is no less critical of the policy of all U.S. administrations that had preceded the current one, going back to 1913!

His critique, in a word, is really directed at the Federal Reserve Bank and all the other highest ranking regulatory financial institutions of American and world capitalism.

Galbraith states in his opening sentences:

I am not, in my own view or that of others, a plausible political adviser to the Bush administration but I would like to suggest that it could be on course for a powerful political disaster. Following a period of insane speculation, we are thought now to be facing a recession, possibly even, insofar as there is a difference, a depression. On this the new administration agrees; it has given its support for two measures for strengthening the economy. Both have proved useless in the past ... They are reliance on the Federal Reserve and reliance on tax reduction for support to the economy....

Ever since 1913, the founding year of the Federal Reserve, there have been great hopes for the stabilizing effect of its actions.... [But the] succession of boom and bust, or inflation and recession has continued ever since.

He concludes his criticism of the Bush administration’s plan to stop the slide downward and reinvigorate the U.S. economy by stating his view that if it continues on its present course, it “faces political difficulty, even disaster.” But most significantly, aside from stating his opinion that none of the remedies now being applied have worked for the last 88 years, or are likely to work now, Galbraith himself, however, offers no way out of the current crisis faced by American and world capitalism.

So what does this debate among American capitalism’s economic experts over the future of the American economy really mean? First and foremost it clearly suggests that none of them really knows what to do to fix it or how it will all turn out. Galbraith, at least, is honest enough to offer no “solution.”

We will get a far clearer understanding of what is happening to the world capitalist economy—and why—by taking a closer look at the problems facing Japan and those in charge of extricating the world’s second-largest economy from its decade of stagnation. And as we shall see, Japan’s problems are far from unique to Japan.

A strange paradox: simultaneous deflation and inflation!

On the fateful morning of March 12, The New York Times featured on its front page this headline: “Deflation shackles Japan, Blocking Hope of Recovery: Signs Point to a Slide Back Into a Recession as Prices and Land Values Plummet.”

But, while prices are falling (deflation), how is it possible that the yen is also depreciating (inflation)? That’s a contradiction that defies the logic of common sense. After all, a generalized fall in the prices of commodities ordinarily means a relative rise in the value of the given country’s currency. That is, when prices fall, the dollar, mark or yen would normally buy more of the cheapened goods.

It’s important to explain how this can happen since it’s not a problem faced by Japanese capitalism alone. Far from it. The same kind of paradoxical phenomena is happening everywhere in the capitalist world including here in the United States, albeit not nearly as dramatically as in Japan—but only for the time being.

Simply put, the cheapening of the cost of production of manufactured goods, due for the most part to the steady introduction of new technology in industry, has vastly increased the productivity of human labor. Thus, historically, prices have declined in accord with the ever-greater productive capacity of human labor power due primarily to technological development.

In other words, the value of all commodities is determined by the quantity of socially necessary, generalized, average human labor power incorporated in each commodity. But the built-in inflationary process that has plagued the entire capitalist world for most of the 20th century has masked the ever-decreasing cost of production.

Thus, the average price of all manufactured goods has steadily risen faster than the fall in their average cost of production! That’s what it means to say that inflation is only two, three, four, six or more percent as has been reported for as far back as anyone alive today can remember—except for the deflation of commodity prices in the first terrible years of the Great Depression.

The answer to the seeming paradox of inflation and deflation taking place at the same time derives from the fact that the world monetary system is no longer based on gold and other precious metals. Let’s look more closely at how and why this change in the world monetary system was instituted. It will serve at the same time to help explain the current paradoxical simultaneousness of deflation and inflation.

Keynes overthrows gold—Adam Smith’s “invisible hand”1

To be sure, occasional outbreaks of inflation at different times and places everywhere in the world have been occurring for at least a couple of thousand years. But the system of built-in, permanent, institutionalized inflation was introduced only in 1944. That was the year that the representatives of the faction of world imperialism headed by Britain, France and the United States—who were well on their way at that time to victory in World War II over the opposing faction headed by Germany, Italy and Japan—met in Bretton Woods, New Hampshire, to lay the foundations for instituting a major change in the world capitalist economic system.

In the first place we need to know why such a goal was deemed urgently necessary. It’s because the Great Depression of the 1930s shook world capitalism to its foundations—opening up a pre-revolutionary decade on a global scale.

World capitalism was saved from the threat of socialist revolution by two main factors. The first, was the betrayal of the world workers’ revolutionary movement by the labor and socialist lieutenants of the capitalist class, and the attendant failure of the world working class to construct a new revolutionary leadership in time. And the second factor, also rooted in misleadership of the workers’ movement, was the outbreak of the Second World War.

That war, paid for by scores of millions dead and wounded, was what it took to get the world capitalist economy back onto the road of recovery by the destruction of the massive surplus product that caused the broadest and deepest global crisis of overproduction so far.

Thus, as World War II was coming to an end, capitalism’s economic experts desperately searched for some way to avoid another deep crisis of overproduction like the one triggered by the fateful 1929 stock market crash—justly fearing that next time they may not succeed in thwarting the historic movement for a world socialist order.

British economist, John Maynard Keynes and other capitalist economic experts successfully cobbled together a plan that convinced capitalism’s key leaders that it could work. The basic idea was to establish a system for moderating the boom and bust cycles of capitalist production and forestall, or at least postpone, the outbreak of another, even more destructive global capitalist economic, social and political crisis.

The answer to the seeming paradox of inflation and deflation taking place at the same time derives from the fact that Keynes’s scheme changed the nature of the world capitalist monetary system. Thus, money today is no longer what money had been throughout the history of capitalism.

Before Bretton Woods, money was primarily gold and silver coins—or paper currency issued by governments but redeemable on demand in specified weights of gold or silver. That kind of money was a very reliable measure of value and standard of price, key functions of money as a medium of exchange.

But to make a very long story short, the trouble with money which is solidly backed by gold is that it does its job too well—it too rigidly measures the values of commodities and makes it extremely difficult for governments to institutionalize a system of deficit financing as a mechanism for softening the boom-bust cycles of capitalist production.

The key to the Keynesian system was to overcome this difficulty by gradually separating the world monetary system from gold. This allowed governments to expand and contract the paper currency in circulation without it becoming immediately apparent that the currency was being diluted.

However, while it has worked quite well for half a century, it has also resulted in a generalized and ongoing devaluation of all currencies. This is because, the inexorable tendency has been that more paper currency tends to be inserted into the economy to soften a downturn than is taken out in order to cool an overheating economy.

But this trend toward currency devaluations is hidden by the fact that without a golden base to the world monetary system the only measure of any country’s currency is in relation to all other currencies. That means that it is possible for all currencies to (more or less) simultaneously fall in value so that no one really knows the absolute value of any currency in terms of its actual purchasing power—only its value relative to other currencies.

Thus the increased productivity of labor reduces the value of commodities but, depending on the rate of inflation, the price of commodities either continues to rise or the extent of inflation is masked by the increased productivity of human labor power.

We saw a preview of how this comes to pass here in the United States when the so-called “inflacession” (a neologism combining the words “inflation” and “recession”) roiled the U.S. economy in the 1970s. It was only the relative stability of the other major world economies that gave the U.S. economy enough time for Keynesian counter-measures to take affect.

But everything changes for the worse when the entire capitalist world finds itself being dragged down together into the mire of a global crisis of overproduction combined with an accelerating rate of inflation as capitalists desperately attempt to restart their stagnant economies by printing and injecting masses of new currency into the system.

Consequently, if the global capitalist economy cannot be restabilized, and as we have suggested, the ruling class itself sees no way to work such a miracle, the fate in store for the world working class promises to be an even more drastic collapse of living standards.

And if there are any who think that the workers of the world will take it lying down, they are in for a big surprise.

A Short Introduction to Marxist Economics

The laws of capitalist economics are accessible to anyone who wants to understand Marx’s analysis of capitalist economy. However, it takes a reasonable amount of interest and effort. What follows is a very short introduction to an understanding of the fundamental contradiction of capitalist economy: the falling rate of profit.

First, on the economic laws governing wages and profit and the contradictory relation between these two key categories of capitalist economics:

Wages are the price of a given quantity of labor power. Their value is determined by how much it costs workers to buy enough of life’s necessities for themselves and their dependents. Without a wage high enough to support workers and their families they would be unable to raise the next generation of workers to supply the future needs of capitalists. Not to mention the capitalists’ need to ensure that their workers are alive and healthy enough to come back to work hard the next day.

If they are paid too little, workers cannot survive, much less continue working for their employer for very long. However, because capitalists, like any other buyers, will not pay more than what the market demands, they assiduously strive to keep wages down as close to subsistence levels as they possibly can.

Let’s assume that workers reproduce the value of their wages in around four hours on average. Workers are fully able to work much longer than what Marx calls “the necessary labor time.” But the capitalist—all other things being equal—is not compelled to pay a higher wage for a day’s labor consisting of eight hours than he would have to pay for a day lasting four hours or 12 hours, since the amount needed for one day’s subsistence doesn’t substantially change.

If workers on average are compelled to work eight hours for a day’s pay, the boss gets the value produced in the extra four hours for free! And if they work 12 hours, the boss gets twice as much free labor!

To be sure, in real life there is a never-ending struggle between labor and capital over how much a day’s labor is worth. That varying amount depends in great part on what the worker thinks his labor power is worth. And that conception is a result of the history of the given working class’s success in winning a living wage which varies from country to country and from region to region. That’s one of the reasons why Marx calls the part of capital that goes toward wages variable capital.

It varies because workers and capitalists have a diametrically opposed opinion on what is a living wage. (That’s what the class struggle is all about.)

We come now to the contradiction between the two components of invested capital, what Marx calls constant and variable capital. The tendency of the rate of profit to fall is the fundamental contradiction that will bring the entire structure of world capitalism tumbling down. Here is how the contradiction is manifested:

Constant capital—that is, the portion of capital invested in factory buildings, machines, and raw materials—is merely reproduced in commodities, creating no new added value.

On the other hand, as has been briefly indicated above, variable capital, the portion spent on labor power, tends always to be less than the value of the surplus product produced by the worker. Thus, workers both reproduce the value of their wages and add new value to the commodities produced.

In other words, machines can do no more than transfer the portion of their value used up in the course of the production of commodities since even automatic machines can’t produce anything unless there are humans to turn them on and off, maintain them, transport the commodities, and distribute them to wholesalers and retailers. And even if completely automatic production were achieved, there would be no workers, no wages, no money to exchange for the goods produced, and thus zero surplus value and zero profit.

Consequently, long before the rate of profit falls to zero, a massive crisis of overproduction is inevitable.

For those whose appetite for further understanding has been whetted by the preceding contributions and who wish to learn more, there is no substitute for reading Marx’s Capital itself. Even a serious study of the first and most difficult chapter in the first of three volumes of this most important of Marx’s many contributions to the science of society will bring a reward in higher understanding that would be well worth the effort for those who think the world needs changing and want to help change it for the better.

—N.W.

Write us!

[email protected]